inherited annuity taxation irs

If you inherit an annuity you may have to pay taxes on your money. Because your wife chose to cash in the annuity a portion of what she received will be income from the invested funds.

Inherited Annuities What Are My Options 2022

Because of this only 148 of your 565 monthly payout will be subject to ordinary.

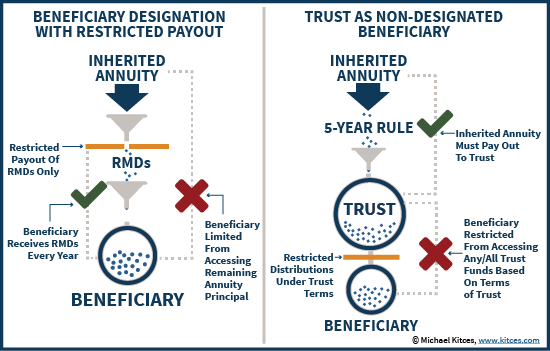

. You live longer than 10 years. If a trust charity or estate is the beneficiary of a. So consult your tax advisor.

Different tax consequences exist for spouse versus non-spouse beneficiaries. Annual payments of 4000 10 of your original investment is non-taxable. According to the IRS.

These payments are not tax-free however. People inheriting an annuity owe income tax on the difference between the principal paid into the annuity and the value of the annuity at the annuitants death. Fixed period annuities - pay a fixed amount to an annuitant at regular intervals for a definite length of time.

The earnings are taxable over the life of the payments. The SECURE Act which was signed into law in 2020 changed the rules for taxes on inherited IRAs for most. Can I sell an inherited annuity.

If a beneficiary opts to receive the money all at once they must pay taxes immediately. How the SECURE Act changed the rules for taxes on inherited IRAs. Variable annuities - make payments to an annuitant varying in amount.

The beneficiarys relationship to the purchaser and the payout option thats selected can determine how an inherited annuity is. Annuities are taxed as ordinary income when inherited. While having a guaranteed lifetime income sounds appealing it might be in your best interest to use this.

An annuity is a financial product that can be passed down from one generation to another. Surviving spouses can change the original contract. The basis of property inherited from a decedent is.

IRS Publication 575 says that in general those inheriting annuities pay taxes the same way that the original annuity owner would. Tax Consequences of Inherited Annuities. You have an annuity purchased for 40000 with after-tax money.

In turn taxation of annuity distributions. The internal revenue service IRS taxes annuity income to the extent of gains distributed from the contract and gains are distributed first. How taxes are paid on an.

To determine if the sale of inherited property is taxable you must first determine your basis in the property. Tax obligations may possibly be deferred by rolling the lump-sum distribution over into an individual retirement account. Its basically returning to you all of the money you paid them after tax plus interest.

You should receive a Form 1099-R. The proceeds of inheritance are taxable.

What Is An Inherited Non Qualified Annuity

Trust Vs Restricted Payout As Annuity Beneficiary

What Is The Tax Rate On An Inherited Annuity Smartasset

Inheritance Annuities Know Your Annuity Contract Transamerica

How To Avoid Paying Taxes On An Inherited Annuity Smartasset

Annuity Taxation How Are Annuities Taxed

Inherited Annuities What Are My Options 2022

Annuity Taxation How Various Annuities Are Taxed

Inherited Non Qualified Annuities For Spouses Non Spouses And Trusts Bsmg Brokers Service Marketing Group

Tax Forms Irs Tax Forms Bankrate Com

Annuities And Taxes Annuity Tax Benefits And Strategies

Annuity Tax Consequences Taxes And Selling Annuity Settlements

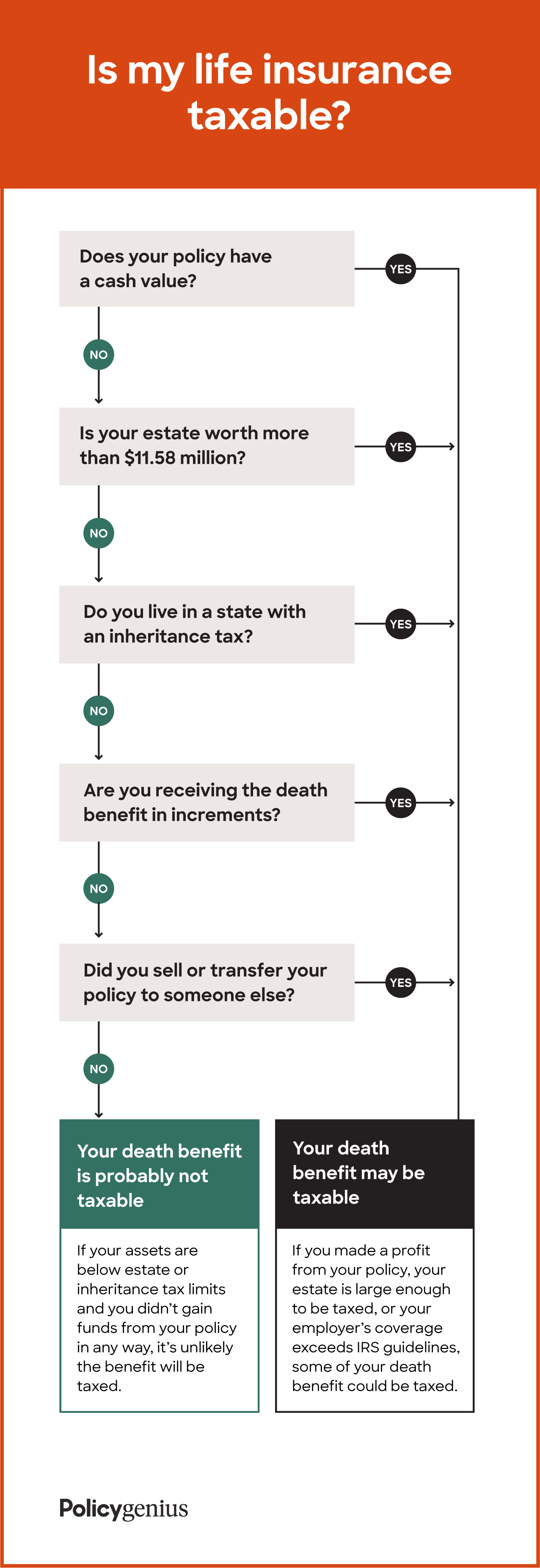

Is Life Insurance Taxable Policygenius

How To Prove Funds Are Inheritance To The Irs

:max_bytes(150000):strip_icc()/success-1093889_1920-73785c60ea884a3eb06341d5e7422b07.jpg)

How Are Nonqualified Variable Annuities Taxed

Retirement Plans Faqs Regarding Required Minimum Distributions Internal Revenue Service

Inherited Annuity Common Questions Answered

What Is The Tax Rate On An Inherited Annuity Smartasset

Publication 575 2021 Pension And Annuity Income Internal Revenue Service